Bonus tax calculator 2020

Ad Enter Your Tax Information. Tax Calculator.

Paye Tax Calculator Top Sellers 52 Off Www Ingeniovirtual Com

Bonus Pay Calculator Tool.

. Federal Bonus Tax Percent Calculator. YourTax Tax calculator Compare. This is state-by state compliant.

Calculate how tax changes will affect your pocket. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech.

The Viventium Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses. It can be used for the 201314 to 202122 income years. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

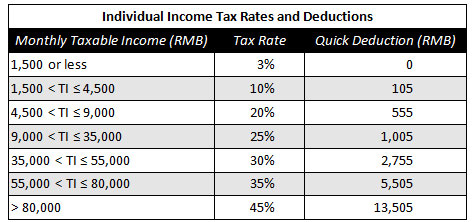

This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Compute your net income PAYE income tax and SSNIT deduction. Enter up to six different hourly rates to estimate after-tax wages for.

A tax calculator for the 2020 tax year including salary bonus travel allowance pension and annuity for different periods and age groups. This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States. Its so easy to.

Which tax year would you like to calculate. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. The latest budget information from April 2022 is used to.

This bonus tax aggregate calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Check this if income is annual.

If your state does. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Sage Income Tax Calculator.

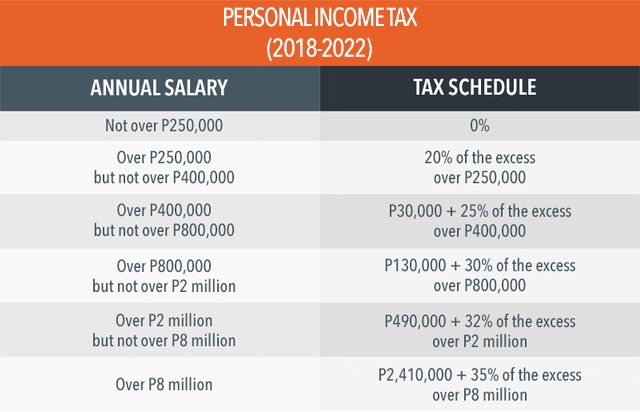

Use our Bonus Tax Calculator to see the amount of tax paid on a bonus on top of regular salary. How to use BIR Tax. The Tax Caculator Philipines 2022 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag-IBIG Monthy Contribution Tables for the computation.

This calculator helps you to calculate the tax you owe on your taxable income for the full income year. Median household income in 2020 was 67340. 04082020 Eat Out To Help Out Calculator.

2023 Mar 2022 - Feb 2023 2022 Mar 2021 - Feb 2022 2021 Mar 2020 - Feb 2021 2020 Mar 2019 - Feb 2020 What is your total salary before. See What Credits and Deductions Apply to You. Your employer withholds a 62 Social Security tax and a.

Germany S Vehicle Tax System Small Steps Towards Future Proof Incentives For Low Emission Vehicles International Council On Clean Transportation

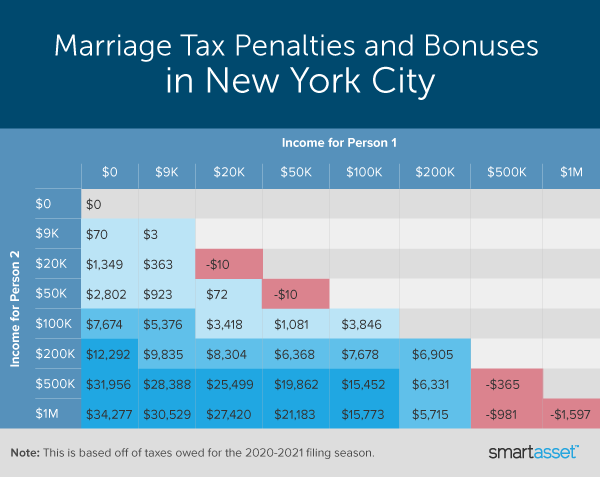

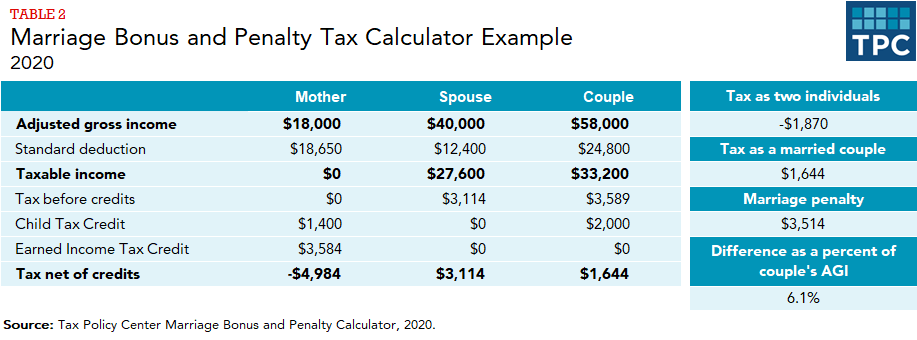

Marriage Penalty Vs Marriage Bonus How Taxes Work

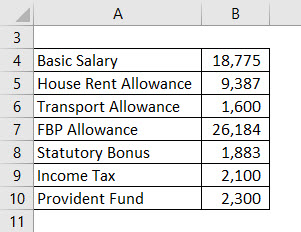

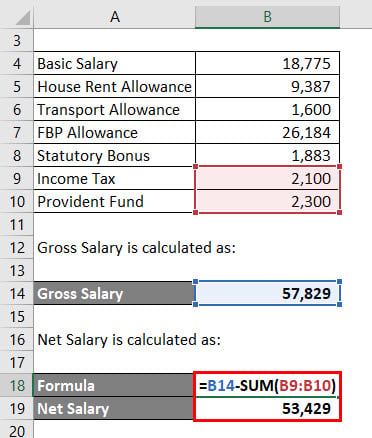

Salary Formula Calculate Salary Calculator Excel Template

What Are Marriage Penalties And Bonuses Tax Policy Center

How Bonuses Are Taxed Calculator The Turbotax Blog

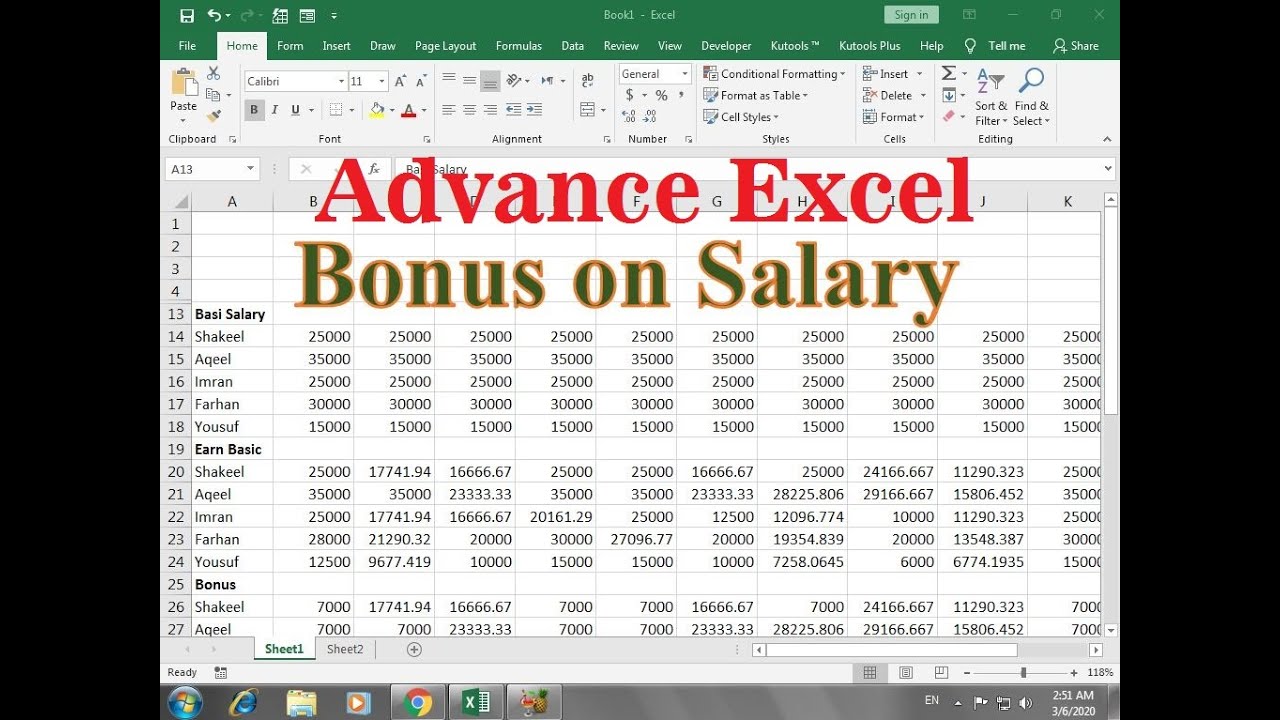

How To Calculate Bonus On Salary In Excel Youtube

Rmc Calculator Armyreenlistment

How To Calculate Tax On Salary Factory Sale 56 Off Www Ingeniovirtual Com

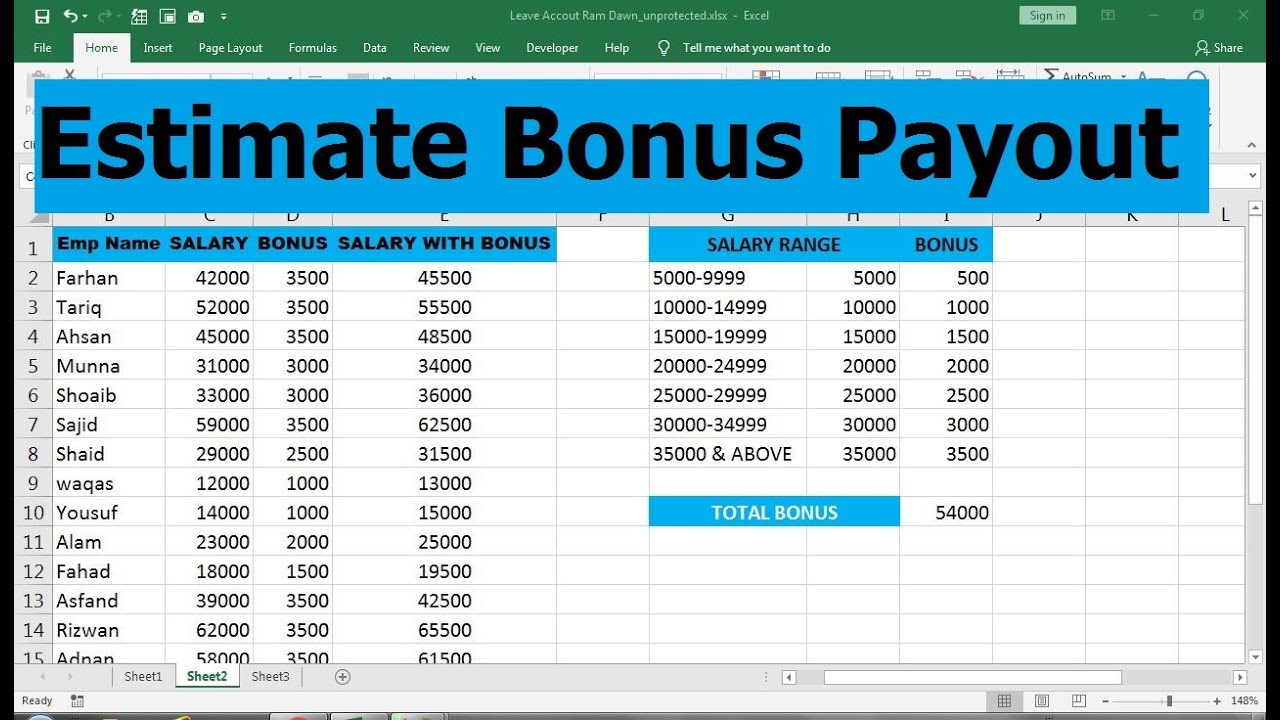

Bonus Calculation Excel Sheet Youtube

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

How Bonuses Are Taxed Calculator The Turbotax Blog

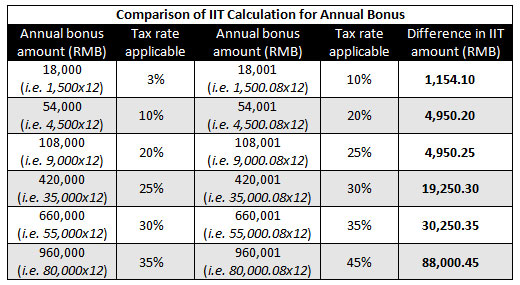

Bonus Tax Rates Aggregate Bonus Pay Calculator Onpay

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Tax Calculator Compute Your New Income Tax

Avanti Bonus Calculator

Salary Formula Calculate Salary Calculator Excel Template